People spend their whole lives working hard for their family

and loved ones. Holding on their professional life and creating a valve of

greater professional goals helps people to establish a strong financial excellence.

People tend to believe in investing their finances into something which is more

beneficial and helps in sustaining financially secure future. Investments are

broadly defined as abstracts like, time, energy, or matter which is spent for

creating a hope of futuristic based benefits. These benefits are expected to be

acquired within a specific date or time. For many people investments can have

different meanings depending upon their personal beliefs. In finance,

Investments are defined as a process of putting money into creation of assets

with a positive expectation of capital appreciation, dividends and earnings.

Insurance in Modern days is considered to be the best option for futuristic

benefits.

Investment insurance plans basically aim for target audience

which understand the market risks and want to insure the investments that they

own. Insurance not only provides them with safety coverage of their investments

but also helps in providing tax exemptions on investments. INVESTMENT-PLAN Therefore

making them a tax free investment. Investing for beginners is much easier than

at the later stage. For beginners the rate of premium is much more less than at

the latter stage. In case of occurrence of death of the insurance holder the

benefits are given to the nominee chosen by the insurance holder. An investment

insurance plan has a specific time frame till which an insurance holder needs

to pay premiums. This Time frame is selected by the insurance buyer at the time

of buying the policy. Ulip

Plan or Unit Linked Plan is defined as a combination of insurance as well as

investments. The premium paid by the policy holder is utilized by the insurance

provider to provide insurance cover back to the policy holder whereas the rest

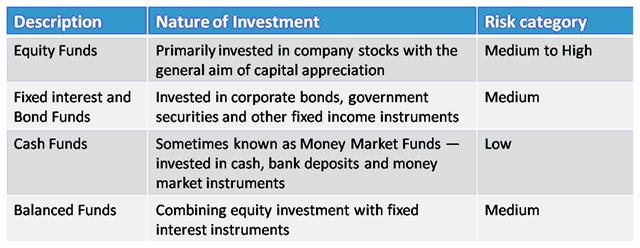

of portion is invested in various equity and debt schemes. Unit linked policy

holders are given features like top up facilities along with an option of

switching funds during the tenure of the policy.

Source: http://www.policyx.com/blogs/562/